The Power of Tax-Free Compounding

Tax-Free Compounding Makes Retirement Accounts the Smart Way to Save

Throughout my long career in investment management and specifically within the hedge fund industry, the term “Annualized Return” is everywhere. Fund managers often brag about their annualized returns for certain periods, which are usually and conveniently the periods that reflect their best performance. What they don’t tout are the tax consequences of their investing or trading. Generally, the more a fund manager trades the more taxable gains (or losses) are generated. If your investments are within taxable accounts, the more turnover (short-term capital gains are taxed at higher ordinary rates), the lower your after-tax returns are likely to be. Each investor in the fund has their own unique tax circumstance so while “Annualized Return” may not tell the whole story, it is the most reasonable metric for an investment manager to report. Wow, did I just give the oft-vilified hedge fund managers a break?

The best way to minimize the material effect of taxes on the value of your investment portfolio is to take advantage of the tax-benefits of various types of retirement accounts. IRAs and employer plans allow us to invest in the most tax-efficient way. Below, I will discuss the three most common types of retirement plans and their relative strengths and weaknesses.

The No-Brainer – Company-sponsored plan with matching contributions!

If your employer has a 401K or 403B program offering “matching” contributions, you should contribute as much as you reasonably can to take advantage of their match. The upsides and downsides of participating in an employer-sponsored plan are:

Upside:

- Employee contributions up to $18,500 (for 2018) can be made annually and are excluded from taxable income. There is a “catch-up” contribution allowance of $6,000 for those age 50 and over.

- Any company matching contribution is found money that along with your invested contributions will grow tax-free until distributed. The limit for combined employee and employer contributions is $55,000 for 2018.

- Many 401K plans allow participants to take out loans up to the lesser of 50% of their account value or $50,000.

- Once you leave the employ of the company, you can roll it into your new employer’s plan or an IRA.

Downside:

- Potentially limited investment options. You plan advisor will select a menu of investment options from which you may choose.

- Distributions are taxable and those taken prior to age 59 ½ are subject to a 10% penalty unless you have a qualifying hardship or exemption.

- Costs of plan administration may be borne by the participants.

Check the costs and fees associated with the plan and the investments. The plan sponsor is a fiduciary and is required to provide low-cost options.

Traditional IRA

Whether or not you can participate in an employer retirement plan, you may contribute to a Traditional or Roth IRA, although there are limitations based on your income levels.

Upside:

Contributions up to $5,500 (for 2018) can be made annually and are excluded from taxable income. There is a “catch-up” contribution allowance of $1,000 for those age 50 and over.

- Investment income grows tax-free.

- Nearly unlimited investment options.

- By naming a beneficiary, the assets in an IRA avoid (expensive) probate should the IRA owner die.

- Easy set-up with any broker and no third-party administration is needed.

Downside:

- Distributions are taxable and those taken prior to age 59 ½ are subject to a 10% penalty unless you have a qualifying hardship or exemption.

- Loans may not be taken against balances.

- You can’t contribute to an IRA after age 70 ½ and must start taking Required Minimum Withdrawals or “RMD” at that age. A 50% penalty is imposed for failure to take the RMD. OUCH!

Roth IRA

Upside:

- Contributions up to $5,500 (for 2018) can be made annually and there is a “catch-up” contribution allowance of $1,000 for those age 50 and over.

- Contributions can continue to be made past age 70 ½ if the owner has “earned” income.

- Investment income grows tax-free.

- Nearly unlimited investment options.

- There are no Required Minimum Distributions, so the Roth IRA balance may continue to grow making it a valuable estate planning tool as your heirs won’t pay taxes on the inheritance or distributions.

- Distributions taken are tax-free.

- Easy set-up with any broker and no third-party administration is needed.

Downside:

- While distributions are not taxable, any taken prior to age 59 ½ are subject to a 10% penalty unless you have a qualifying hardship or exemption.

- Loans may not be taken against balances.

“Wow”, you say. “That’s a lot of information to absorb. How about a “made-up, real-life” example to illustrate?”

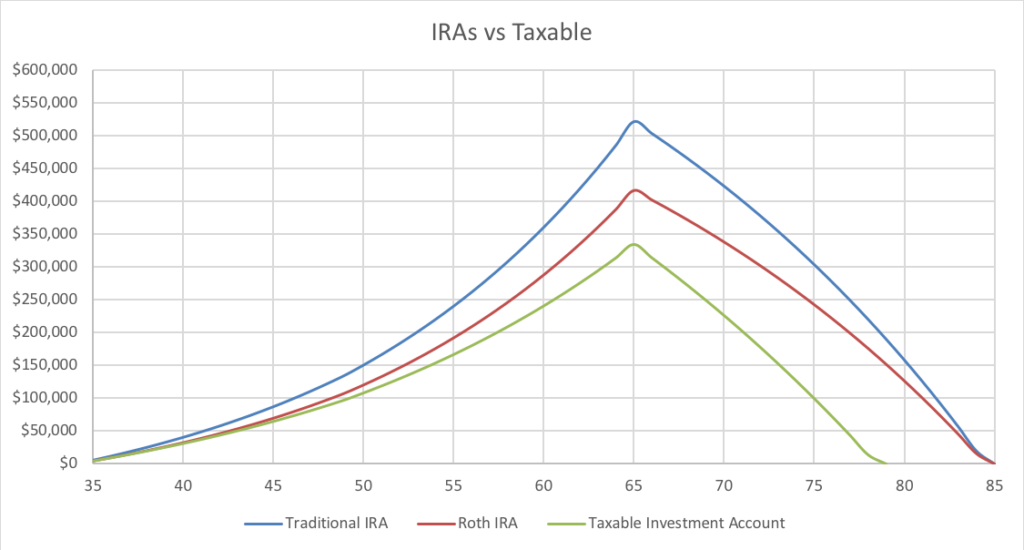

Well since you asked, the chart below provides an illustration of the comparative advantages of either type of IRA over setting aside after-tax dollars in a taxable investment account. In this example, we make the following assumptions about a 35 year-old person with a 20% marginal tax rate:

- Contributes the maximum to a Traditional IRA ($5,500 for 2018, and for simplicity’s sake contributes the same each year until $1,000 catch-up is allowed at age 50); the after-tax equivalent to a Roth IRA ($4,400/year – $5,500 net of the 20% marginal income tax) or taxable investment account each year until retirement at age 65.

- Earns a pre-tax investment return of 6% annually in each account through retirement at age 65 and 4% thereafter as more conservative investments are made to preserve principal through retirement. As noted above, returns are tax-free in both IRAs.

- At age 66, annual withdrawals/redemptions are made so that $30,000 after-tax is available to the owner to maintain their lifestyle into retirement ($37,500 pre-tax in Traditional IRA which assumes 20% marginal tax rate).

- A marginal tax rate of 20% both before and after retirement. Typically, your tax rate in retirement is lower making the difference even larger as after-tax distributions at the lower rate are even larger.

The Inescapable Conclusion:

Whereas the retiree will be able to draw upon the either of the IRA accounts for 20 years or from 65 until age 85, they will drain their taxable investment account entirely in only 14 years by age 79! No more luxury vacations, club memberships, fancy cars or gifts for your children and grandchildren. Notice how I left out the most likely, but depressing need which is to address post-retirement healthcare costs. Please note that while the Traditional IRA account value remains higher than the Roth IRA, that is only a function of deferring taxes. The key takeaway is that both will provide similar after-tax retirement money until roughly the same point in time and much longer than if you invest in a taxable account.

I’m sure many of you are past age 35, but it is still worth leveraging the tax-advantages of retirement accounts at any time during your career. The government put IRAs and 401Ks in place to incentivize retirement savings. It is a gift – accept it with gratitude.

As with all matters related to taxation and retirement planning, you should consult your tax professional and/or financial advisor or call Maidstone Wealth Management to arrange a consultation.

See the Pre-tax -vs- After-tax compounding chart for more information.