What is the value of your Mortgage Interest Deduction under the TCJA?

For decades, the mortgage interest deduction for homeowners was a major incentive to owning and financing a home. A large percentage of homeowners used the itemized deduction schedule when filing their taxes and received meaningful tax relief not only from the mortgage interest, but from local property and state income taxes as well. Prior to 2018, there was a more modest threshold for utilizing your itemized deductions. The standard deduction for a married couple filing jointly (“MFJ”) in 2017 was $12,700 and all state income tax (or sales tax) and personal property taxes were deductible so a large number of homeowners’ itemized deductions exceeded $12,700. Now that the standard deduction for 2018 under the Tax Cut and Jobs Act (“TCJA”) has been raised to $24,000 and the deductibility of the combination of state and local taxes is limited to $10,000, significantly fewer people will see tax savings from itemizing, negating the tax-reducing value of the mortgage interest deduction and property tax payments.

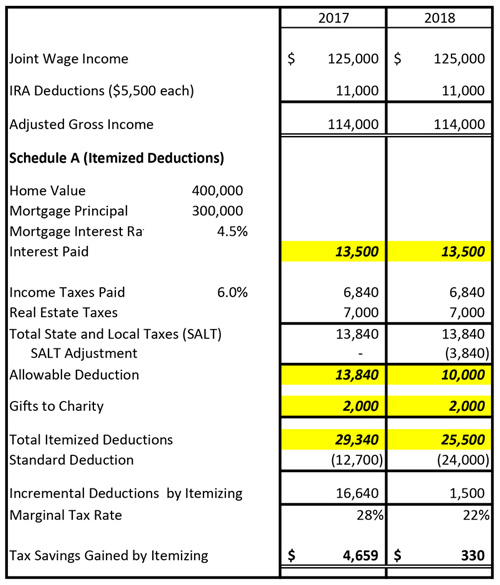

Given the limitations on previously deductible expenses under the TCJA, the mortgage interest deduction would be relevant to far fewer households in 2018 than in 2017. To illustrate the difference between the value of the mortgage interest deduction in 2017 and 2018, I will use a married couple who own a home in a high income and property tax state like New York. I will keep the example simple by assuming the couple receives only wage income (no investment, rental or other income) and employer health benefits, and wisely contributes the maximum to their IRAs.

As the table below shows, a New York-based couple making a nice combined income, holding a $300,000 mortgage, paying their annual property taxes and making charitable contributions will get nearly no tax benefit from property tax, mortgage interest payments or their charitable giving in 2018. The loss of these material tax benefits available under the prior tax regime could alter the calculus when deciding whether to buy or rent, how much to spend on a home or how much to finance through a mortgage.

I know my thinking won’t make me popular among mortgage lenders, real estate agents or even financial advisors. After all, the more you borrow on your home, the more you have to invest with folks like me. As fiduciaries, we are obligated to put the interests of clients first and changes in regulations and tax laws need to be incorporated into our thinking about each client’s overall financial situation to best achieve his or her objectives. A mortgage is a form of leverage and many people borrow on their homes while making stock or bond investments, which can be profitable. The loss of benefit from the mortgage interest deduction just makes the return necessary to justify borrowing on your home while investing in securities markets a bit higher. In 2017, if your combined marginal federal and state income tax rates were 33% and your mortgage rate were 4.5%, your after-tax cost of financing was 3.0%. Seemed like a bargain and it was. In 2018, if there is no incremental benefit to the interest deduction and your after-tax cost is the same 4.5% as your pre-tax cost, you would need a pre-tax return on investment of 6.75% (to net 4.5% after taxes) to call it a wash.

Naturally there are benefits to taking out a mortgage to allow you to purchase a home. The flexibility of having cash available to live the lifestyle you want or save and invest for retirement or the kids’ education has real value. Also, there are clearly many emotional benefits to owning a home or far more people would be renting. Whether you own a home or are considering buying, the changes in the value of the mortgage interest and property tax deductions under the TCJA should be considered. If you would like to discuss how the new tax law may affect your situation, please don’t hesitate to contact me.

As always, I appreciate your comments, questions and open discussion.

Stephen Lulla

Founder and CIO

Maidstone Wealth Management LLC

10 West Main St., Cambridge, NY 12816

(o) 518 350-4877

(c) 518 915-4500