1st Quarter 2025 Results and Market Commentary

The broad stock market indices were down in the first quarter as the new administration policies priorities started to sink in. The exuberance of markets looking forward to lower regulatory hurdles and oversight of businesses gave way to prospects of slower economic growth caused by uncertainty around business investment and stubborn inflation to be exacerbated by tariffs.

The rise in big tech in the fourth quarter of 2024 reversed course in the first quarter of 2025 as it became clear that the excitement around all things AI and proximity to President Trump will not be a panacea or promise of clear sailing. A striking example, which I teased in last quarter’s commentary, was the pushback against Elon Musk and Tesla for his role as leader of DOGE. His interventions in European politics as well as in the U.S. have turned off prospective electric vehicle customers, who generally lean left politically. Customers have basically boycotted Tesla which has cost his company market share worldwide. Tesla’s share price had been cut by more than half from its December 2024 peak.

Now I will address the elephant in (or stomping through) the room and not lost on me is that the elephant is the symbol of the party controlling the executive suite and both chambers. Trump’s tariff policies have roiled world markets since he walked out like Moses with the “tariff tablets” on April 2 detailing his tariff rates on U.S. trading partners. Since the first quarter ended, the market crash in response to Trump’s “Liberation Day” tariff pronouncements have made any market movements in the first quarter seem inconsequential. The downdraft in equity markets on each of the two days after the announcement (which came after the close on April 2nd) were each the worst days since the world shut down from Covid in March of 2020 and the sell-off had continued through April 8th. Markets did recover a good portion of the recent losses on April 9th when Trump announced a 90-day delay of imposing the stiff tariffs on all countries with the exception of China, for which he announced total tariffs of 124% as China announced tariffs on goods imported from the U.S. He still moved forward with across the board 10% tariffs on all imports.

On April 2nd, Trump made public the list of high tariffs that he said were “reciprocal” but were based on a formula that has no bearing on barriers to American imports into the countries upon which they were to be imposed. Many economists and trade policy experts agree that there needs to be adjustments to trade and there are unfair trade practices between the U.S. and some of our trading partners that work against our interests, and I agree with that determination. However, most believe this is a bad approach. I am not alone in my belief that punishing American consumers and companies as well as trading partners, friends and foes alike, is the wrong way to correct the imbalances and will drive our trading partners to look for other trade relationships.

Open and free trade has lifted economies around the world for the last 50 years and the market reaction to Trump’s universally antagonistic approach is evidence of its misguidedness. The Covid pandemic’s supply issues were a wake-up call for our unpreparedness to keep supply chains moving in certain industries, most prominently medical and personal protective equipment that was badly needed and in short supply. The Biden administration put a priority on sourcing semiconductors domestically when it passed the CHIPS act and there are other industries that we need to onshore or have more secure sourcing from allies. That said, we and our trading partners all benefit when non-strategic products are produced by cheaper and available labor overseas.

Just hours before writing this paragraph on April 9th, Trump announced a 90-day delay on imposing the tariffs on all countries except China, which moved the S&P up 8-9% in just a couple of hours. Despite this move up, the markets are still well below where they were on April 2nd and I’m quite sure trust between the U.S. and its trading partners is now quite thin. Also, despite the 90-day delay, businesses are not going to commit to new investment, hiring employees or anything else if they expect the playing field will move hour by hour, day by day and month by month.

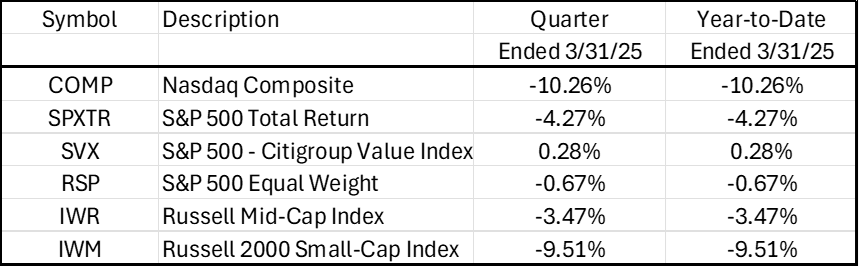

Getting back to the life that seems like years ago, the first quarter performance of the Magnificent 7 is reflected in the poor performance of the Nasdaq Composite Index. The disparities between the performance of growth stocks (“COMP”) versus value stocks (“SVX”) and large capitalization stocks (“SPXTR”) versus mid (“IWR”) and small capitalization (“IWM”) stocks are highlighted in the table below:

Fixed income (bond) markets did well in the quarter as market participants’ fear of a slowing economy led them to believe the Federal Reserve might lower rates this year. Despite pressure from the White House, the Fed is trying to do their work independently of political pressure. That said, the tariff policy pronouncement of April 2 caused a surprise weakening of the dollar and increase in bond yields, which meant bond prices have gone down since quarter end. The exodus of investors in both U.S. stocks and bonds also led to a weakening of the dollar as investors buy dollars to purchase U.S securities and sell dollars when those securities are sold. The bond and dollar weakness grabbed the attention of the Trump economic and tariff advisors more than the stock market selloff.

I have heard from many of you over the last week of tumult in the markets and all your input and concerns are important and give me insight into the confidence or lack of in the administration, the economy, and the direction of both. Therefore, I do encourage you to please contact me with questions about this email, your portfolio, or anything else related to your financial life as my line is always open.

Best regards,

Steve